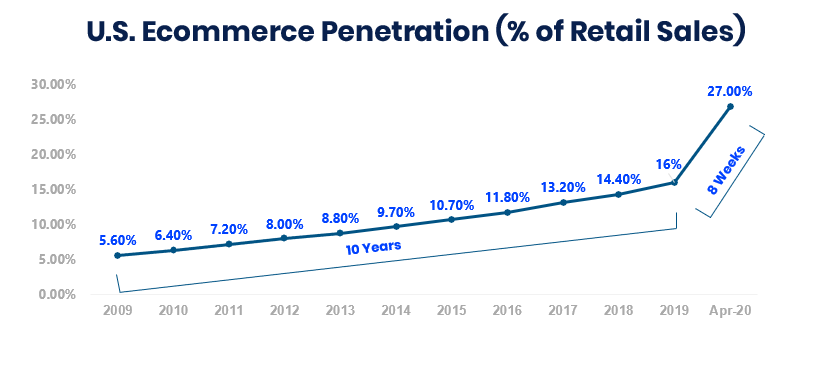

Something we talk about a lot here at Fosdick is how the pandemic has hit the fast-forward button on eCommerce growth in terms of the percentage of total retail sales. By our estimate, the online sales DeLorean has been set AT LEAST 5-years into the future, and we think that might be a very conservative projection.

Still, at 30% of total retail sales, online shopping has in no way reached its potential as a scaled channel. But why?

Still, at 30% of total retail sales, online shopping has in no way reached its potential as a scaled channel. But why?

We think part of the reason is that even now, there are instances when deliver-by dates are just too far out into the future or when timely shipping comes at to great a cost. Rather than shopping for alternatives, many consumers end up abandoning their online carts altogether, telling themselves they’ll just have to run down to the local Target or Walmart after all.

The funny/tragic thing is those same shoppers often don’t make that trip and choose instead to go without. Scenarios like this are good indications of what is actually a necessity. We can’t buy the M&M’s from the aisle cap near checkout if we aren’t already at the store waiting to pay for something we genuinely need.

All this is to suggest that part of brick and mortar’s massive slice of the retail pie is made up of one-off impulse purchases that shoppers do not make in the same way when they shop online.

And with online retailers prioritizing shipping on true necessities, it seems safe to assume then that the eCommerce share for these products is even higher than 30%

Beyond that, if brands and shippers of essential products can maintain efficiency, the folks that only began buying online when the virus hit might just become lifetime converts.Grocery shopping is a prime example of this. U.S. online grocery sales grew 22% in 2019, and stand to surge about 40% this year, according to the Coresight Research U.S. Online Grocery Survey 2020.

Of 1,152 consumers polled, 52% had bought groceries online in the past 12 months — the first time that more than half of respondents had done so. That number has more than doubled over the last two years, Coresight said.